The Serbian Ministry of Finance has introduced significant amendments to the Income Tax Law, specifically targeting non-taxable amounts. Effective from February 1, 2024, to January 31, 2025, these changes encompass various categories such as salary, allowances, and compensations, aiming to provide clarity and ensure fair taxation practices.

Adjustments in Tax-Exempt Amounts

Several noteworthy adjustments have been made, impacting various facets of financial compensation, including but not limited to the following:

- The daily allowance for business trips abroad has been increased to RSD 9,449 (approximately EUR 80) from the previous amount of RSD 8,782 (approximately EUR 70).

- The public transportation cost for commuting has experienced a rise, now standing at RSD 5,398 (approximately EUR 47) compared to the previous amount of RSD 5,017 (approximately EUR 42).

- Christmas gifts for children of employees have been elevated to RSD 13,497 (approximately EUR 115) from the previous amount of RSD 12,544 (EUR 105).

New Non-Taxable Amount

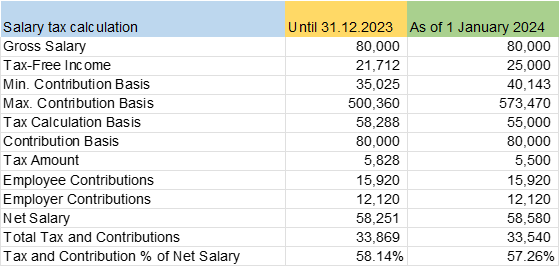

Effective from January 1, 2024, a new non-taxable amount of RSD 25,000 (approx. EUR 215) has been implemented, showcasing the government’s commitment to balancing tax burdens and ensuring fair financial practices. This amount represents a significant increase from the previous RSD 21,712 (EUR 185).

Amendments to Social Security Base

In addition to the changes in non-taxable amounts, amendments to the minimal and maximal social security base have been introduced. These adjustments are crucial in maintaining a balance between social security contributions and individual financial responsibilities.

Impact on Salary Calculation for 2024

Understanding the implications of these changes is essential for businesses and employees alike. The adjustments in tax-exempt amounts and social security bases directly influence salary calculations for the year 2024 (see Fig. 1). Employers need to be well-informed about these modifications to ensure accurate and compliant payroll processing.

To sum it up, the amendments to the Income Tax Law, along with the introduction of new non-taxable amounts and adjustments to social security bases in Serbia, reflect the government’s commitment to fostering a fair and balanced financial environment. These changes not only impact salary calculations but also contribute to creating a more transparent and equitable taxation system for the benefit of both employers and employees. Businesses are advised to stay updated on these changes to ensure compliance with the latest regulations and provide fair financial benefits to their workforce.

For comprehensive guidance on taxation in Serbia or any additional information, feel free to contact our experts at the Eurofast office in Serbia at belgrade@eurofast.eu. We are here to assist you with any inquiries and provide expert advice.

Aleksandar Maljkovic

Tax Advisor

Eurofast Belgrade

belgrade@eurofast.eu