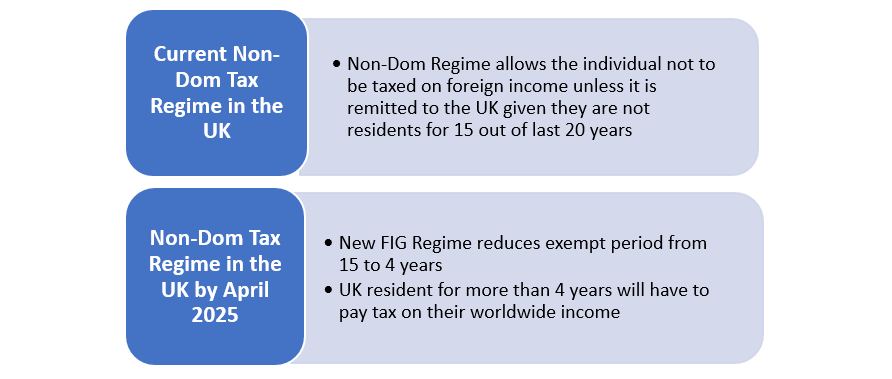

Learn about the upcoming changes in the UK tax landscape as the Non-Domicile Tax Regime is set to be replaced by the Foreign Income & Gains (FIG) regime by April 2025. Discover how the new regulations, featuring a reduction in the exempt period from 15 to 4 years, will impact individuals residing in the UK, potentially altering tax liabilities on worldwide income.

- Cyprus’ Tax Regime and Residency Requirements

Cyprus boasts one of the most favorable Non-Dom Tax regimes globally. Coupled with the upcoming abolishment of the UK’s current Tax Regime, Cyprus emerges as an even more attractive destination for residency seekers. Beyond the standard 183 days rule, prospective individuals can leverage Cyprus’ the 60 days rule, adding another layer of appeal to its residency program. To qualify for Cyprus residency requirements, individuals need to fulfill the 5 main criteria and actions.

- Tax Benefits for Eligible Individuals in Cyprus

Cyprus offers a range of tax benefits to eligible individuals. Those meeting specific criteria, including not being tax residents for 20 consecutive years prior to the tax year or prior to the enforcement of non-domicile rules in 2015, can enjoy:

- complete exemption from taxation on dividends earned

- full tax exemption on interest received

- special defense tax exemption for rental income

However, it’s important to note that contributions to the General Health System in Cyprus (GESY) are not exempted, though the financial impact remains relatively modest.

- Notable Exceptions to Tax Regime in Cyprus

Remuneration over €55,000 originating from Cyprus, enjoys a 50% tax exemption and applies for max period of 17 years provided that for at least 15 years before the employment was not a Cyprus Tax resident, that is truly a competitive advantage than other jurisdictions.

Other important benefits apply to:

- Overseas pensions

- Life insurance schemes

- Provident funds

- Cyprus-regulated fund managers

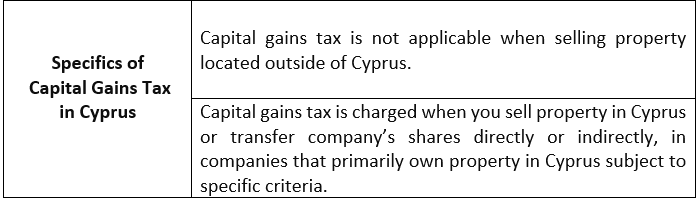

- Understanding Capital Gains Tax in Cyprus

Cyprus’ capital gains tax regime is nuanced.

- Other Financial Perks in Cyprus

Beyond tax exemptions, Cyprus offers several financial perks.

Absence of:

- Immovable property tax

- Wealth tax

- Inheritance tax

- Gift tax

- Strategic Advantages of Cyprus Residency

The appeal of Cyprus extends beyond its tax regime. Situated strategically between three continents, coupled with its stable political environment and perfect sunny weather, Cyprus presents an enticing option for relocation. These factors, combined with the tax benefits, make Cyprus an appealing destination for individuals worldwide, including Cypriots residing abroad.

- Appeal to a Global Audience

Cyprus attracts not only high-net-worth individuals from around the globe but also Cypriots living abroad, particularly in the UK, Australia, and the USA. The strategic location, stable political environment, and favorable tax regime position Cyprus as a top choice for relocation.

- Assistance in Residency Acquisition

Eurofast team of experienced professionals in Cyprus stands ready to assist in exploring all alternatives for obtaining Cyprus residency for the interested individuals. From preparation and submission of relevant forms to communication and representation with authorities, we ensure a seamless experience while undertaking due diligence to meet your needs. Feel free to contact us at [email protected].

Avraam Apostolou

Manager Accounting & Tax

Eurofast Nicosia

[email protected]

Nicos Pilavas

Banking Officer

Eurofast Nicosia

[email protected]