Obtaining a Georgian Tax ID number is essential for anyone planning to engage in economic activities within Georgia. This identification number facilitates a variety of financial and legal transactions, making it a crucial requirement for nonresidents. Here’s a comprehensive guide on how to obtain a Tax ID number in Georgia, and why you might need it.

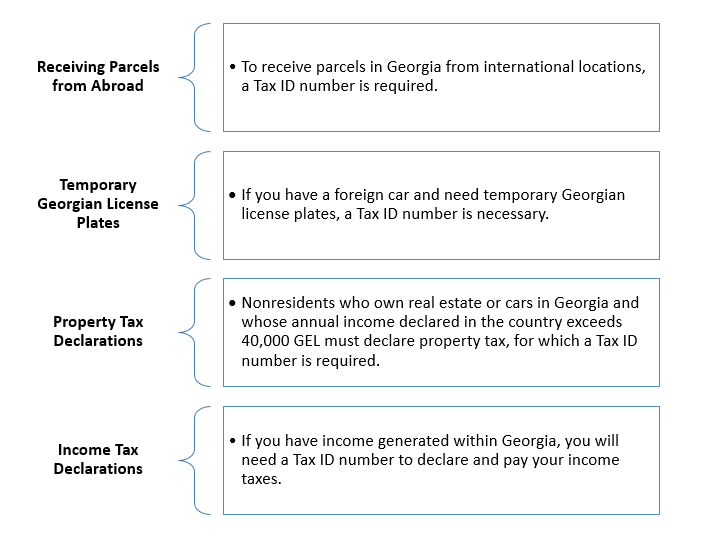

Why You Need a Georgian Tax ID Number

A Georgian Tax ID number is not just a bureaucratic formality. It plays a critical role in various scenarios, including:

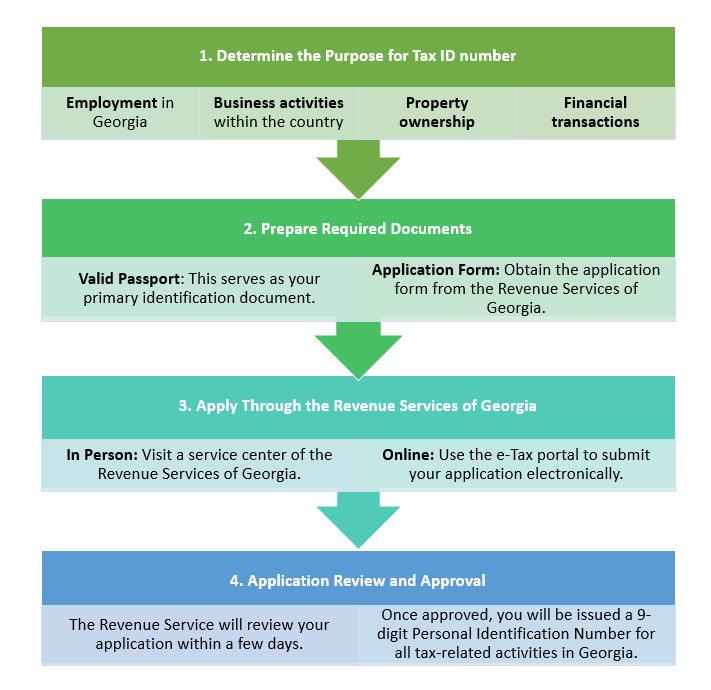

Steps to Obtain a Tax ID Number as a Nonresident Individual

Important Note

If you are already registered as an individual entrepreneur and have opened a tax account, you do not need a separate tax number as an individual. The identification code for an individual entrepreneur and the tax number are the same.

In a nutshell, securing a Tax ID number in Georgia is a straightforward process, but it’s vital for engaging in economic activities within the country. Tax laws and requirements can change, so it’s advisable to seek local legal or tax advice to ensure a smooth process. Stay informed about the latest regulations with Eurofast experts in Georgia at [email protected]

Irina Lopatina

Country Manager

Eurofast Tbilisi

[email protected]