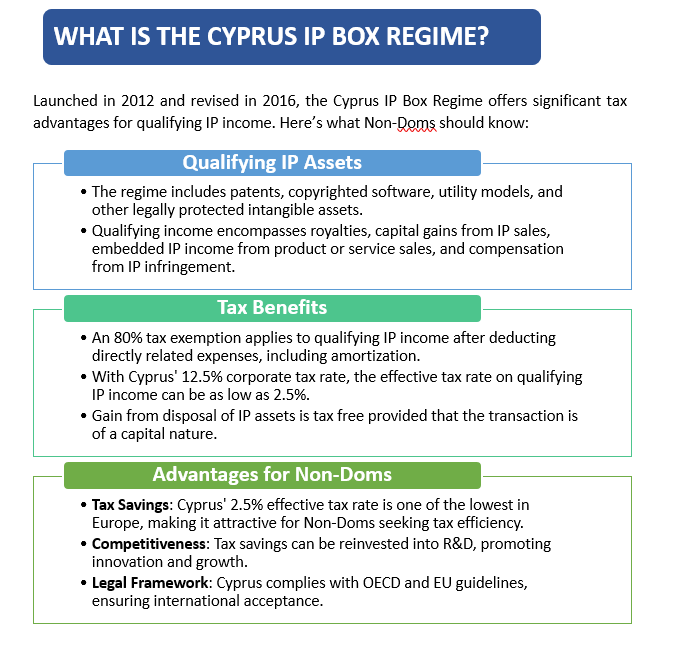

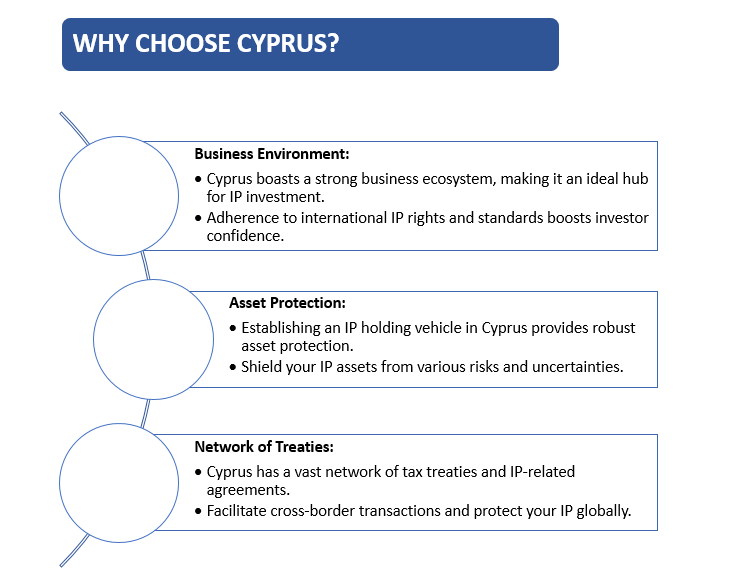

Discover why savvy investors are turning to Cyprus for intellectual property investments amidst the UK’s upcoming Non-Dom rule changes with Eurofast tax experts. As the UK prepares to implement new rules affecting Non-Doms in 2025, insightful investors are seeking alternative jurisdictions for their intellectual property (IP) investments. Cyprus stands out as an appealing option with its attractive IP Box Regime, which promotes innovation, safeguards assets, and reduces tax liabilities.

To wind up, as the UK’s tax landscape changes, Non-Doms should consider Cyprus as a strategic location for IP investment. The IP Box Regime, coupled with Cyprus’ business-friendly environment, legal framework, and tax benefits, makes the island a compelling choice for forward-thinking investors.

Feel free to consult with Eurofast legal and tax professionals in Cyprus to customize your IP strategy to your specific needs at nicosia@eurofast.eu. Eurofast in Cyprus is ready to help you maximize tax efficiency and foster innovation.

Avraam Apostolou

Manager Accounting and Tax

Eurofast Nicosia

nicosia@eurofast.eu

Olena Marutovska

Administrator

Eurofast Nicosia

nicosia@eurofast.eu