In the global fight against financial crimes, transparency and accountability are paramount. Cyprus, through its Registrar of Companies, plays a crucial role in this effort by regulating Ultimate Beneficial Ownership (UBO). This initiative not only aligns Cyprus with international standards but also fortifies its position as a reputable financial jurisdiction.

Regulatory Framework

Cyprus’ UBO regulations are grounded in a robust legal framework designed to enhance financial transparency and combat money laundering:

Identification and Disclosure

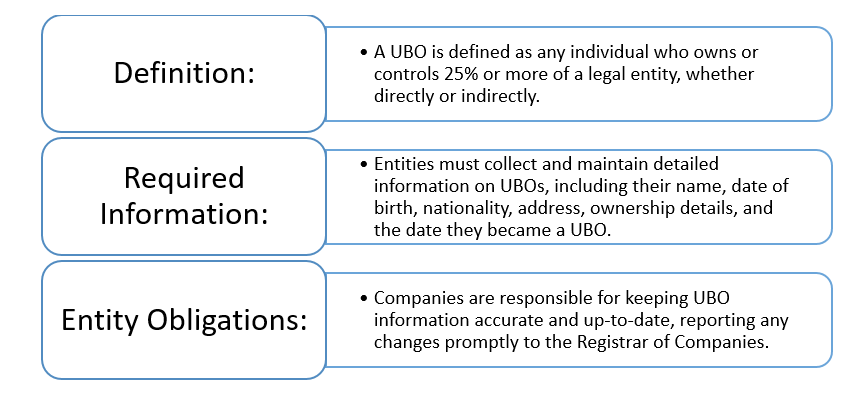

The process of identifying and disclosing UBOs involves detailed requirements to ensure thorough documentation and accountability:

Benefits of UBO Regulation

Implementing UBO regulation yields significant benefits for Cyprus and its financial ecosystem:

- Enhanced Due Diligence: UBO information facilitates comprehensive risk assessments by financial institutions and regulators, mitigating the risk of financial crimes.

- Increased Trust: Transparency in ownership builds trust among investors and business partners, fostering a reliable business environment.

- International Compliance: Adhering to international standards enhances Cyprus’ reputation as a transparent and compliant financial jurisdiction, attracting global business opportunities.

Addressing the Challenges

While the benefits of UBO regulation are clear, there are challenges that need careful management:

- Privacy Concerns: Balancing the need for transparency with individuals’ privacy rights requires a nuanced approach to data management and access.

- Administrative Burden: The compliance requirements can be demanding, especially for smaller companies, necessitating streamlined processes and support.

- Verification Mechanisms: Ensuring the accuracy of UBO information demands robust verification systems to prevent misinformation and fraud.

In conclusion, the regulation of UBOs by the Registrar of Companies in Cyprus is a critical measure in promoting financial integrity and transparency. By addressing the associated challenges and continuously enhancing the regulatory framework, Cyprus can maintain its standing as a reputable and attractive jurisdiction for international business.

At Eurofast, our team of experts in Cyprus boasts extensive experience in corporate matters. We stay at the forefront of legal changes to ensure your compliance with regulations, facilitating smooth and efficient business operations. For any inquiries, please contact us at [email protected].

Marilia Petrou

Corporate Administrator

Eurofast Nicosia

[email protected]