In a significant move aimed at bolstering economic ties, the Bulgarian government has approved a draft agreement with Australia to avoid double taxation on income taxes. This initiative, part of ongoing discussions since the end of 2022, marks a promising development in international trade and investment between the two nations.

BENEFITS OF THE NEW DOUBLE TAX TREATY

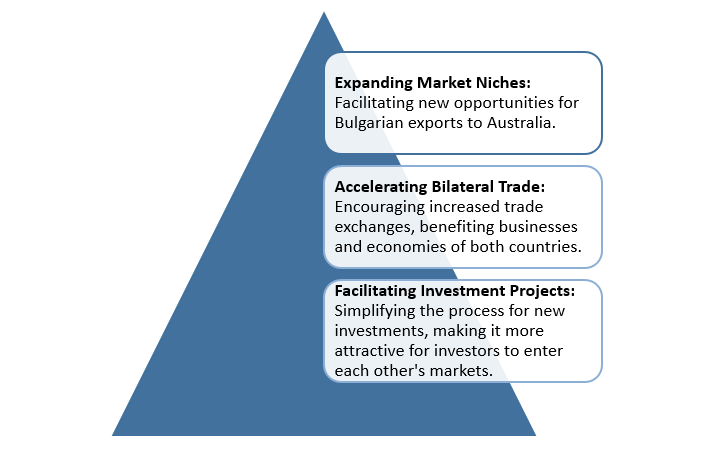

Improved Investment Climate

The new double tax treaty (DTT) is anticipated to enhance the investment climate between Bulgaria and Australia by:

Strategic Importance of Australia

Australia’s growing geopolitical and economic significance cannot be overstated. As a member of key regional and international organizations such as the G20 and the Organization for Economic Co-operation and Development (OECD), Australia’s role in the global economy is pivotal. Additionally, Australia hosts the largest Bulgarian community in the Asia-Pacific region. This community maintains strong connections with Bulgaria, further underscoring the importance of this treaty.

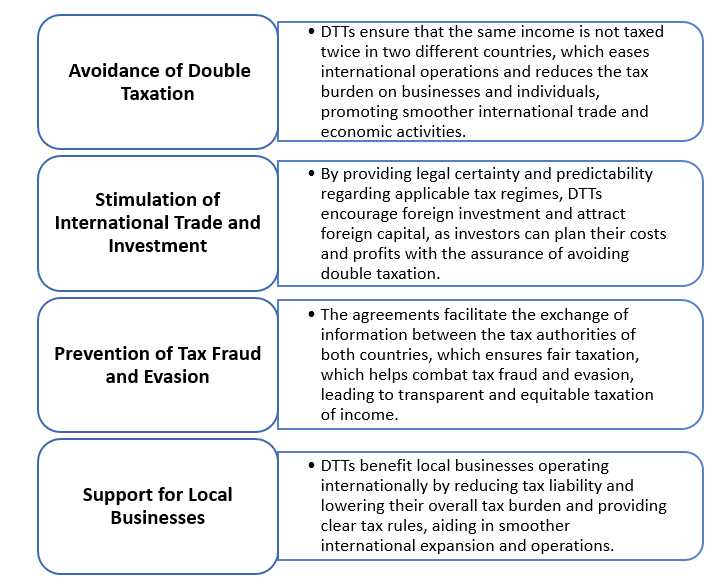

BULGARIA’S EXTENSIVE NETWORK OF DOUBLE TAXATION TREATIES

Bulgaria has established DTTs with 70 countries, playing a crucial role in the nation’s economic growth and development. These agreements offer numerous benefits:

To sum up, the forthcoming DDT between Bulgaria and Australia represents a significant step towards strengthening economic relations, enhancing trade, and fostering investment. Bulgaria’s extensive network of DTTs continues to provide substantial benefits, promoting international business activities and ensuring fair taxation practices. As these agreements evolve, they will continue to play a vital role in shaping Bulgaria’s economic landscape.

For those looking to understand the benefits of becoming a tax resident in Bulgaria or seeking more information about the DTT between Bulgaria and their home country, professional guidance is available. Eurofast experts in the region can help you navigate the complexities of tax residency and double taxation agreements. For detailed assistance and expert advice, please contact [email protected].